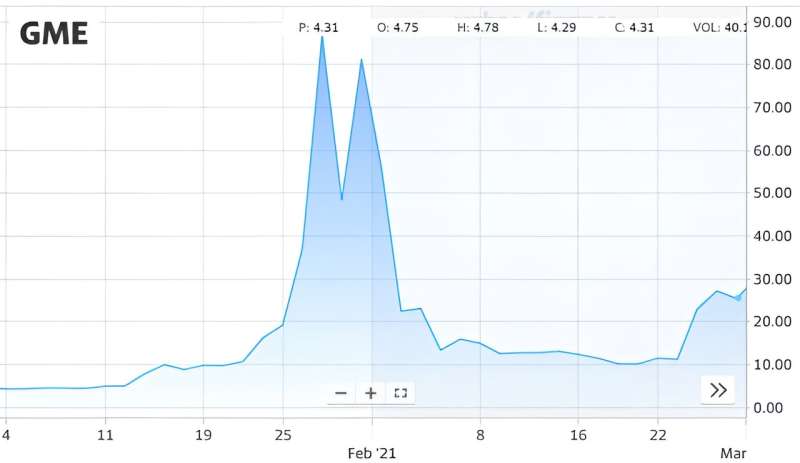

Share price of GameStop stock over January and February 2021. Credit: Yahoo Finance

Three years ago, the stock price of the company GameStop soared over 1,625% in just a week. While it's been speculated the primary cause was unprecedented, organized action among Reddit users using a trading strategy known as a "short squeeze," researchers have now definitively shown a causal relationship between activity on Reddit and the wild market phenomenon. They have published their findings on the pre-print server arXiv.

Some background: selling a stock "short" means borrowing shares from, typically a brokerage form, then selling them. The hope is that the stock will decline in price, enabling the short seller to buy them back at a reduced price, pay back the broker (and incurred borrowing costs, such as interest), then pocket the profit. It's a well-known trading strategy, and on average about 5% company's publicly held stock is shorted.

A "short squeeze" happens when a stock experiences a significant rise in price, perhaps due to an unanticipated rise in profits or some other good news. Short sellers, not wanting to lose money on their short position (which requires the stock price to fall for them to make money), will begin "covering" their short sell, purchases that drive the stock price up. With further increases short sellers might panic, leading to a positive feedback of buying and a rapid rise in the price of the stock. Short sellers get squeezed out of the market for the stock.

The most notable short squeeze in decades was the GameStop short squeeze of January 2021. Notably, it seemed to originate on social media, especially the r/Wallstreetbets subgroup of Reddit. Users there saw GameStop's stock price receding due in part to the pandemic, and approximately 140% of the public stock was sold short, meaning some who had borrowed the stock had re-lent it.

Redditors decided the stock of the company—a brick-and-mortar video game sales company—was undervalued and began buying it up. The buying caused the stock price to rise, panicking short sellers, who bought back their borrowed shares, creating still more panic. In just three and a half weeks the stock price rose 2,702%, making millionaires of some and breaking others.

Some other tech stocks later saw huge gains as well. The large hedge fund Melvin Capital Management LP was shut down a few months later due to the losses it suffered, and basketball star Michael Jordan lost a reported $500 million, almost 25% of his net worth.

The incident led to much attention from the media and from politicians, who vowed investigations and reform to prevent such actions in the future and awakened the professional investment community to the power of social media and private collective action.

But were Reddit users actually the ones behind the short squeeze? Several studies have shown a strong correlation between activity on r/Wallstreetbets and changes in the market indicators of GameStop, but correlation isn't causation. This current study finds specific evidence that supports the hypothesis of coordinated online activity on GameStop and a few other stocks.

Researchers were able to gather very detailed, highly time-resolved data from Pushshift, which copies Reddit activity, and Reddit itself, where users typically share screenshots of their individual trading activity, such as buys, sales, holds and orders, and Twitter. With this they identified three distinct phases of online behavior: Discussion, Action and Visibility.

To test causality—what caused what?—they performed Granger causality testing on the data, developed by English economist and Nobel Laureate Sir Clive Granger in 1969. This statistical method seeks to determine whether one variable forecasts or anticipates another.

It was estimated that the trading of Reddit users averaged about 1% of GameStop's total market capitalization—the value of the entirety of its shares. Granger causality analysis was performed on the hypothesis that GameStop-related activity on social media—Reddit and Twitter—anticipated changes in the number of GameStop shares undergoing trading—the so-called volume.

When analyzed, the data showed a stronger cross-correlation of trading volume with Reddit activity than with the stock price itself—about three times larger—suggesting that the changes observed in trading volume were more tied to discussions on Reddit than reactions to the increasing stock price.

Granger causality analysis performed during each of the three phases showed no anticipatory value in the Discussion phase for all pairs of variables, with a sharp transition on January 13 to strong anticipation of trading volume on Reddit activity. Before this date Reddit users were conversing but not yet influencing the GameStop market price; after, they were actively buying the stock. The Granger Index value of this anticipation remained significant but decreased steadily for the next 12 days.

On January 27th Elon Musk tweeted "Gamestonk!" with a link to Reddit and brought the attention of the short squeeze to the public, at which point Reddit activity no longer anticipates trading volume. Instead, it anticipates discussion on Twitter, as users of the latter, now informed of the market activity, turned to Reddit for information.

The wild swing of GameStop stock price served as an alarm for many investors who were now more aware of the power of social media networks and online communities in influencing financial markets and investment decisions.

"I believe that we provide enough evidence in support of the hypothesis that the community coordinated a collective financial strategy," said lead author Antonio Desiderio of the Technical University of Denmark. It has opened the eyes of institutional investors on Wall Street.

"Our findings offer a deeper understanding of how digital platforms can catalyze collective action; thus, social media can foster large-scale coordination between retail investors."

More information: Antonio Desiderio et al, The causal role of the Reddit collective action on the GameStop short squeeze, arXiv (2024). DOI: 10.48550/arxiv.2401.14999

Journal information: arXiv

© 2024 Science X Network