This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

Reshaping financial content: Enhancing consumer appreciation in Australian professional practice

The by-product of financial advice, known as a Statement of Advice (SOA), serves as a written documentation of financial guidance provided to consumers. Its primary purpose is to ensure accountability for regulatory compliance and consumer protection, as outlined in the Corporations Act (2001) of Australia.

However, due to the intricate nature of mandatory disclosure requirements, SOA documents tend to be extensive and pose challenges in both their creation and comprehension by consumers. Indeed, recent studies have indicated a decline in the recording of consumer relationships within the Australian financial practice.

These limitations prompted Ben Neilson from the University of Southern Queensland to investigate the impact of these laborious documents on consumer appreciation, focusing on the key pillars of comprehension, value and trust.

Neilson initially collected data to assess consumer appreciation levels of the current SOA financial content structure. This data was gathered through a combination of qualitative interviews and quantitative analysis.

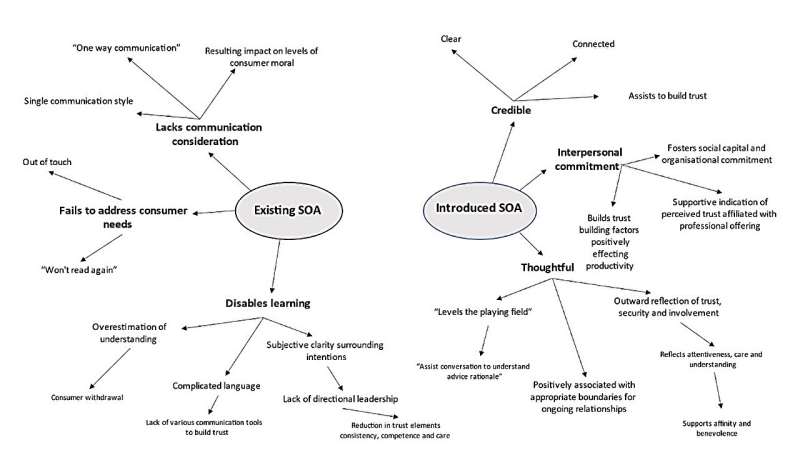

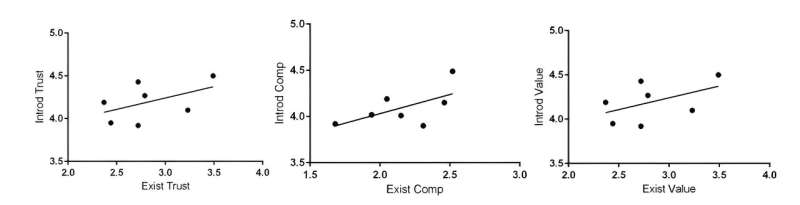

With this valuable data in hand, the researcher introduced a reimagined financial content structure that incorporated language improvements, explanatory videos, and hyperlinks. Subsequently, the impact of this new structure on consumer appreciation was evaluated and compared to the existing structure using a combination of thematic analysis, MANOVA and econometric modeling.

"The findings revealed that the structure of financial content significantly influences consumer appreciation, particularly with respect to clarity, organization and formatting, all of which play pivotal roles in shaping decision-making processes," shared Neilson. "Notably, our restructured financial content received higher levels of consumer appreciation, suggesting the potential for a shift in Australian professional practice."

The study, published in The Journal of Finance and Data Science, provides evidence that may contribute to debates surrounding consumer serviceability, relation of SOA content structure.

More information: Ben Neilson, Investigating the impact financial content structure has on consumer appreciation: An empirical study of Australian statement of advice documents, The Journal of Finance and Data Science (2023). DOI: 10.1016/j.jfds.2023.100103

Provided by KeAi Communications Co.