This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

The playbook of forecasting US Treasury bond returns

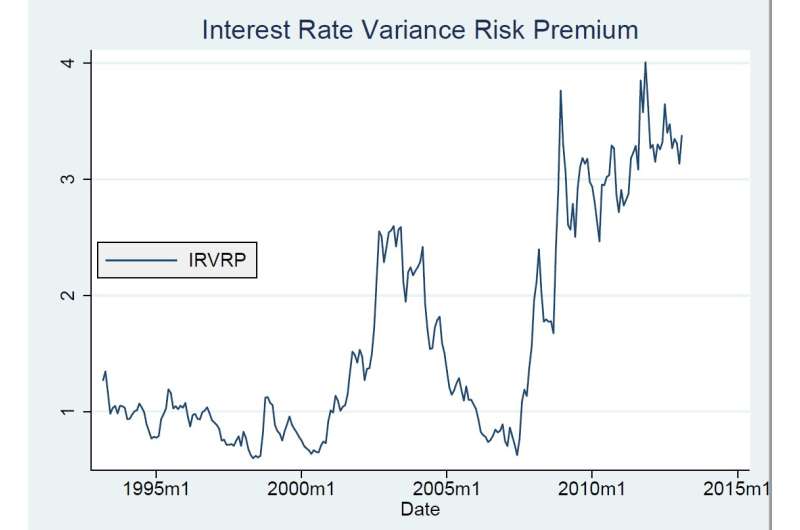

Interest rate variance risk premium (IRVRP), the difference between implied (forward-looking) and realized (backward-looking) variances of interest rates, measures compensation for risk for exposure to volatility in the interest-rate markets.

Bond return predictability can be explained by a number of plausible risk factors, including forward spreads, forward rates, jump risk measures, hidden term structures, and macroeconomic factors. Nonetheless, it remains a fundamental challenge to discover the economic mechanism behind bond return variation.

To that end, in a new study published in The Journal of Finance and Data Science, an international team of researchers from China and the US constructed the IRVRP for the cash market of the U.S. Treasury securities.

The researchers measured the implied variance using options on U.S. interest rate swaps, or swaptions. They also measured realized variance of the U.S. Treasury securities, that is, U.S. government bonds, as a sophisticated average of their past squared returns.

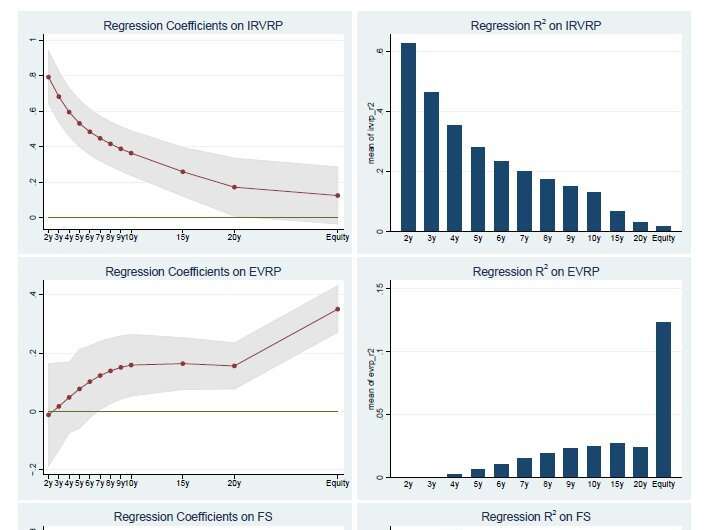

"We find that IRVRP is a strong predictor of U.S. Treasury bond excess returns of maturities ranging between one and ten years for return horizons up to six months," said Olesya Grishchenko, lead author of the study.

"Hence, IRVRP appears to be capturing the risk at the relatively short horizons and is associated with short-run risks." This result is demonstrated by downward-sloping term structure of estimated coefficients and corresponding R-squared values of univariate regressions.

At the same time, the team found that EVRP emerged as a predictor of longer-term bond returns—maturities beyond ten years— and as such, likely to be associated with long-run risks.

"EVRP is a measure similar to IRVRP that reflects compensation for exposure to volatility in the aggregate equity market," explained Grishchenko. "Similar to the case in IRVRP, forward spread (FS), a difference between longer- and shorter-term interest rates, is a classical predictor of U.S. Treasury securities excess returns' it explains the variation in them for relatively longer maturities. As such, it is likely to be associated with long-run risks."

"Explanatory power of IRVRP is the highest at shorter maturities and is decreasing monotonically with longer maturities," said Hao Zhou, corresponding author of the study. "In contrast, explanatory power of EVRP is the lowest at shorter maturities and is increasing monotonically with longer maturities. The dynamics of FS represents some intermediate situation between IRVRP and EVRP."

The team rationalized their main findings within a consumption-based model with long-run risk, economic uncertainty and inflation non-neutrality. In the model, IRVRP is related to short-run risk only, while standard forward-rate-based factors are associated with both short-run and long-run risks in the economy.

"Our model qualitatively replicates the predictability pattern of IRVRP for U.S. Treasury bond returns," concluded Zhou. "Together with our findings, it provides useful insights on different volatility risks in driving bond risk premium dynamics for market participants and monetary policy makers in practice."

More information: Olesya V. Grishchenko et al, Term structure of interest rates with short-run and long-run risks, The Journal of Finance and Data Science (2022). DOI: 10.1016/j.jfds.2022.09.001

Provided by KeAi Communications Co., Ltd.