This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

A year since Russia invaded Ukraine, new research shows global financial impact

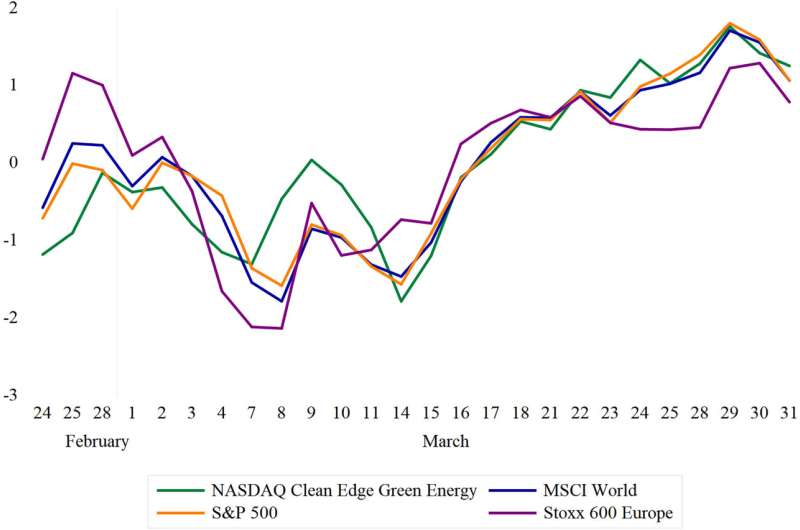

On February 24, 2022, the Russian invasion of Ukraine escalated a dramatic conflict, with devastating effects both in human costs on the ground and international impact. Beyond the immediate reaction of world stock markets, newly published research from five UK-leading finance academics details how the global economy is still enduring the war's consequences a year later.

Researchers used a range of statistical modeling to compare the economic fallout from the war with that of the recent COVID-19 pandemic and not-too-distant 2008 global financial crisis (GFC). While existing evidence has outlined the impact of sanctions, which vary across countries and industries, this new study gives a broader view of financial market stability around the world.

Overall, the study found that stock markets and commodities responded much faster to the Russian invasion than COVID-19 or the GFC, when there was a lag of up to a week before investors reacted. The researchers say this shows the invasion was immediately seen as serious news on the global financial stage.

However, the intensity of the market response to the invasion was noticeably smaller than COVID-19 or the GFC, which researchers believe is due to an expectation that war wouldn't last long. Past war-like experiences have been very different—primarily involving one-off terrorist attacks, beyond the European continent, without widespread sanctions—and so investors may have drawn a false sense of security by comparing these events with the Russo-Ukrainian war.

In the short-term, researchers expect the war to restrict economic growth and increase inflation. GDP growth in 2023 is projected to slow to 2.25% worldwide, to 0.5% in the US and to 0.25% in the Euro area—well below pre-war forecasts. Global inflationary pressure that had been building since the COVID-19 pandemic has also been accelerated by the war's impact on energy and food prices.

Longer term, researchers warn that the war's macroeconomic impact may plunge global economies into recession—unless the right policy responses are prioritized now. Concerns sparked by the war around energy security and affordability may overtake the recent focus on efficiency and low-carbon 'green' goals, undermining climate action and jeopardizing 2050 Net Zero targets. Rising food prices, production shortfalls and trade disruptions also pose major risks to international society.

Research author Professor of Finance at Queen Mary University of London, said, "Our study shows the need for stronger links between international relations and finance. Financial markets did not expect the Russian invasion of Ukraine, nor did they expect the war to be prolonged, with repercussions so far-reaching that even a year later they are still unfolding."

"Research is ongoing as the war continues, but this may prove the greatest hit to the global economy since the 2008 financial crisis, even exceeding the impact of the COVID-19 pandemic. It remains to be seen what remedial steps will be taken to tackle a global recession."

The findings are published in the journal International Review of Financial Analysis.

More information: Marwan Izzeldin et al, The impact of the Russian-Ukrainian war on global financial markets, International Review of Financial Analysis (2023). DOI: 10.1016/j.irfa.2023.102598

Provided by Queen Mary, University of London